Finb is a project we worked on Term 2 and Term 3 in a total duration of 6 months as a part of the first-year group project in RCA. Our project partners Rainbird AI and E&Y approached us with a brief of "reinventing how the organization identifies, assist or minimize risk or harm to vulnerable people while interacting with the banking and finance industries." Later presentations made to Quo Money and TISA for their review.

Financial Vulnerability is a key priority for Financial Institutions, and Rainbird's Artificial Intelligence technology can make very complex decisions and scenarios that can offer great importance for prevention and assistance to people who may face financial difficulties.

According to the research findings (both conducted in primary and secondary), half of the UK adults are financially vulnerable. Furthermore, due to the obstacles that manage money caused by lack of financial illiteracy, especially among young people, causes money-related anxiety affecting people's life choices and economic well-being.

Since each individual has different needs and preferences on managing money, we conducted a problem statement that focuses on "How might we empower young people to improve their financial well-being and help the financial institution identify vulnerable customers through tailored support systems?"

We presented a financial platform that analyzes financial behaviour by using artificial intelligence to provide tailored action plans to improve users' financial well-being and help them make better financial decisions.

With completing the action plans, Finb helps you to build better wellbeing points to make the complex world of finance fun, easy, and rewarding for your financial freedom and allows you to reveal your financial potential by taking the ownership of your data with full transparency, unlike the other existing products.

Problem

Financial Vulnerability has many faces that can be seen or unseen. According to the recent FCA report published, half of the UK adults (25.6 million) are financially vulnerable. About 30% of adults with low financial resilience have low or erratic income, are over‐indebted, have low savings, have low emotional resilience, or lack support structure.

Research Highlights

The initial research showed us where the pain points could be. Top insights we acquired:

-

Trust issue ( people tend not to trust bank)

-

Relationship ( vulnerable people’s relationship with family and friends)

-

Inactive ( inactive with their financial situation )

-

Personalism ( financial advice )

-

Assistance (both physical and mental)

-

Security

-

F.I.Q (lack of financial knowledge and management)

To understand the issue deeply, at first, we have conducted face to face and phone interviews with 18 users, reached out to the three financial charities and four financial institutions in the UK to hear what they think about the current situation.

"Vulnerability does not always means financial vulnerability."

-Monica

“I have tons of student loans, I just want to know how will I be able to pay these school loan off and If I can’t what are the consequences.”

-Rachael

“I am unaware of any other such products that can identify and assist vulnerable people.”

"Nearly half of UK adults never checked their credit report”

-Experian

"Personal finance is about 80 percent behavior. It is only about 20 percent head knowledge."

-Dave Ramsey

"HUMAN IMPORTANT”

-EY

User Persona

While we were doing our interviews, we created persona cards and empathy maps to see the pain points and opportunities that people encounter.

Problem Framing

The difficulty of managing money, low resilience, the lack of financial education system, and money related anxiety are affecting people's work and life, especially among young people.

Key Insight

However many of the vulnerable patterns leave a trace that can be tracked by various data such as behavioral characteristics (personalities) and customer support systems.

Hence, enabling an opportunity for preventive measures such as identification and a customized solution for financial behaviour change leading to a better financial well being.

Furthermore, we can help people by providing financial literacy who may have or will experience low financial resilience with low knowledge in managing their finances.

HMW?

So, How might we empower young people to improve their financial wellbeing and help financial institution to identify vulnerable customers through tailored support systems?

Service Proposition 'FinB'

Finb is an online financial platform that analyzes financial behaviour by using artificial intelligence to provide tailored action plans to improve users’ financial wellbeing and help them make better financial decisions.

With completing the action plans, Finb helps you to build a better wellbeing points to make the complex world of finance fun, easy, and rewarding for your financial freedom and allows you reveal your financial potential by taking the ownership of your data with full transparency, unlike the other existing products.

Key Features

While designing the interaction, the key features to be considered was,

-

First, it should utilize the Rainbird AI, Machine Learning & data sources to identify and assist consumers.

-

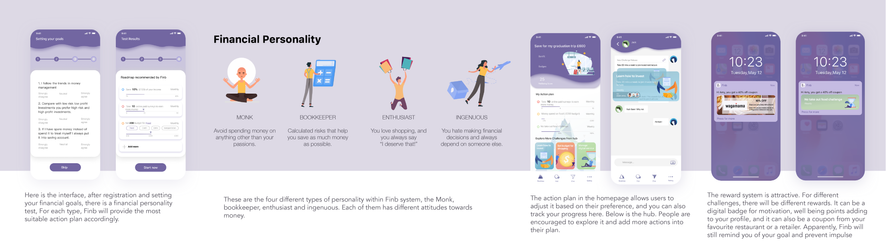

Secondly, we have Personality Testing, which enables the ability of Finb to gain deeper, empathic human insights and communication to contextualize the need of the customer.

-

Third, with data of customers' personality and financial data, it enables the ability to offer personalized and engaging action plans to complete.

-

Fourth, Finb can offer advanced tools such as predictive suggestions within action plans which engage users to play, learn, share and manage their finances wisely.

-

Fifth, Finb system uses gamification and incentive reward mechanisms to engage and encourage customers towards positive behavior change and long term financial success with Well Being Points.

Iterations & Co - Creation Workshops

During the project more than 30 user testing were done for the iteration of the design, then we organised a co-creation activity to find out what users truly like in order to fully understand the interaction between the user and the service. Here is a snapshot of our workshop.

From the co-creation activity, we also observe that people have to desire to spy, help and communicate, which adds more collaboration into the money management process!

This co-creation activity showed us the importance of sharing information and the importance of designing a financial community. In terms of the investigation of motivations that causes a positive behavioral change in finances, Tali Sharot mentions "people listen to the positive information," as she continues, "highlighting what other people are doing, it is a powerful incentive." According to these findings, our participants validated during the co-creation that, how necessary the learning by doing on a financial platform is. The social hub feature, which was one of our previous feature ideas, was designed in detail later in this co-creation workshop.

Thus, now Finb does not only allow you to complete the action plans offered by Finb and also allows them to participate in the hub and interact with your peers. If you want to know more strategies to manage your money, you can explore more actions and challenges in the hub, which your friends and other people participated.

In the other co-creation activity, people liked the online community and participated actively. They experienced the service and then shared their feelings and doubts about the features to help us improve Finb into the final version. We received some of the comments indicate that people had concerns about whether they can trust in the content that will be shared in the hub.

To answer the need, we practiced our idea about different financial characteristics again to improve our service into a model that Finb can recommend the action plan contents according to your financial personality. Secondly, the participants can evaluate the challenge by checking how many people have participated in it. By building an active community, we are using the power of knowledge sharing.

Here is the final version of our Interface, which displays the features of this service. Furthermore, we will see how our target customer 'Amy' finds out Finb and participates in it and starts to build her financial resilience within a short period of time.

Validation

In the final validation tests, we introduced our project to the users and created an environment where they can interact with Finb, such as social media accounts. Their evaluations were on the feasibility of the user interface.

User

“I like the idea of encourage students to manage money with some rewards based on action plans and wellbeing point, and it’s easy to understand.”

“My motivation of sharing a challenge to friends is not so strong, but if I can compete with others I will share it.”

“I really like the homepage which shows the action plan rather than my score.”

“In the hub, it would be more motivational if I can preview some comments below like Instagram.”

Financial Institution

“It can make clients more active in online bank and raise their awareness of financial management, for the Bank, it can be used as a risk assessment and monitoring tool for our clients’ financial status.”

- Bank branch president of ICBC

“I like the system, it’s easy to care about clients all the time by using technology, which I can’t do that, and every advice from the system should not be mandatory, we don’t force clients to do anything.”

- Customer Service Manager of BOC

Acknowledgement

We want to thank our project tutors at RCA and our partners Rainbird and E&Y, who made it possible for us to work and did not withhold their mentorship throughout the project.

We also want to show our appreciation to the project participants who added value to this project and participated, even though we had to communicate mainly through digital environments and in different time zones due to the pandemic. Thank you for showing your support.

Project made with Guoxing Song (MA Service Desig), Li Ning (MA Service Design),

Sijon Thapa (MA Service Design), Yosuke Hatanaka (MA Service Design), Yulin Ran (MA Service Design).